We strive to make great advances in growing your income with our experience

TLB Micro Credit has a well-structured organisational chart ensuring proper management and effective internal control systems.

Trans- Liberal (TLB Micro- Credit) is an established financial institution under the laws of Ghana, specialized in the provision and management of credit product. Our firm operates in the micro credit segment of the financial eco-system, offering short term loans to both formal and informal sector.

We are here to help what you are seeking to achieve

Our potential clients are segmented along these main groups - micro-small medium scale business, start-up entrepreneurs, individual commercial workers and services to the formally employed individuals.

-

Our Mission

We aim to meet our customers and clientele's financial needs with innovative, excellent and unrivaled services available in the industry today by applying focused market research and practical problem solving approach.

-

Our Vision

The Vision is to be the preferred hub for customer delivery and satisfaction by the year 2023 in Ghana and the world force by 2025. This will continue to be the driving forces as we seek to provide proficient services.

-

Our Objectives

• To partner clients and businesses with the aim of increasing profitability.

• Offering a trusted customer friendly and engaging business advice.

• To produce highly motivated workforce focused on customer satisfaction.

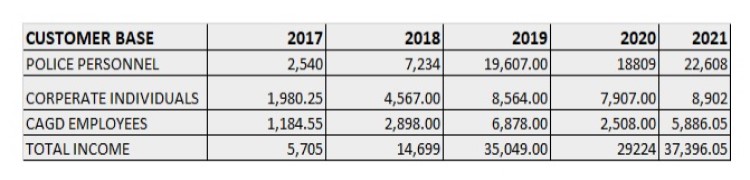

Summary of Financial Performance.

TLB tailored personal loans and payroll loans make it easy to access and grow your income - over 400 people have trusted us to make their dreams come to reality.

Our Performance Indicators.

The List below outlines some of our key performance indicators.

- The Customer's satisfaction.

- The revenue per a customer.

- The profit margin.

- The Customer's retention rate.

TLB Progress

The above performance indicators clearly outlines the believe we have in providing an objective evidence of porgress towards attaining results in every single transaction with our client(s).

DIRECTIVE OF THE USE OF

GHANA CARD

As a financial institution, we are subjected towards the directives of

BANK OF GHANA especially with the use of Ghana-Card and use of Dud Cheques.

Below are some directives we want our clients/customers to seriously observe.

- Dud Cheques are punishable by law.

- Severe consequences now apply; Or up to 5 years jail term if you issue a Dud cheque! (Section 313(A) of the criminal Offences Act 1960 (Act 29) as amended. Bank of Ghana Directive.

- Effective 1st July 2020, only the Ghana card will be used for transaction at our office in our accordance with BOG regulations.

We are appreciated by our clients!

I'm highly delighted to receive direct and instant loan from TLB micro - credit to meet my pressing family needs. You are really good and God bless your work; indeed TLB Loan is great.

Bridget A.K Adjei

Police OfficerTLB's speedy disbursment of funds saved me from extra charges for clearing of my goods from the port. keep up your good works.

Joyce Amuzu

SupplierI initially had a challenge with the whole process but upon further explanations i applied and was really cool.I would gladly encourage everyone to apply for loan.

Bianca Yeboah

Designer